We’re talking perhaps 50 invoices every year. This was easy because I wrote a small amount of invoices each year, and I had a record of what income would reach my account. In the past I’ve used Excel to track my income, as well as expenses. Keeping on top of both income and expenses requires a reliable and easy to use tool. The latter is very straightforward, but the company return is a little more tricky, because it requires me to collate all my little sources of income, from things like hosting customers, YouTube, Adsense, Patreon, Amazon (et al) with expenses I’ve had for those avenues. Hence, we need to file a company return, and also file a joint personal return.

#Turbo tax quick books full#

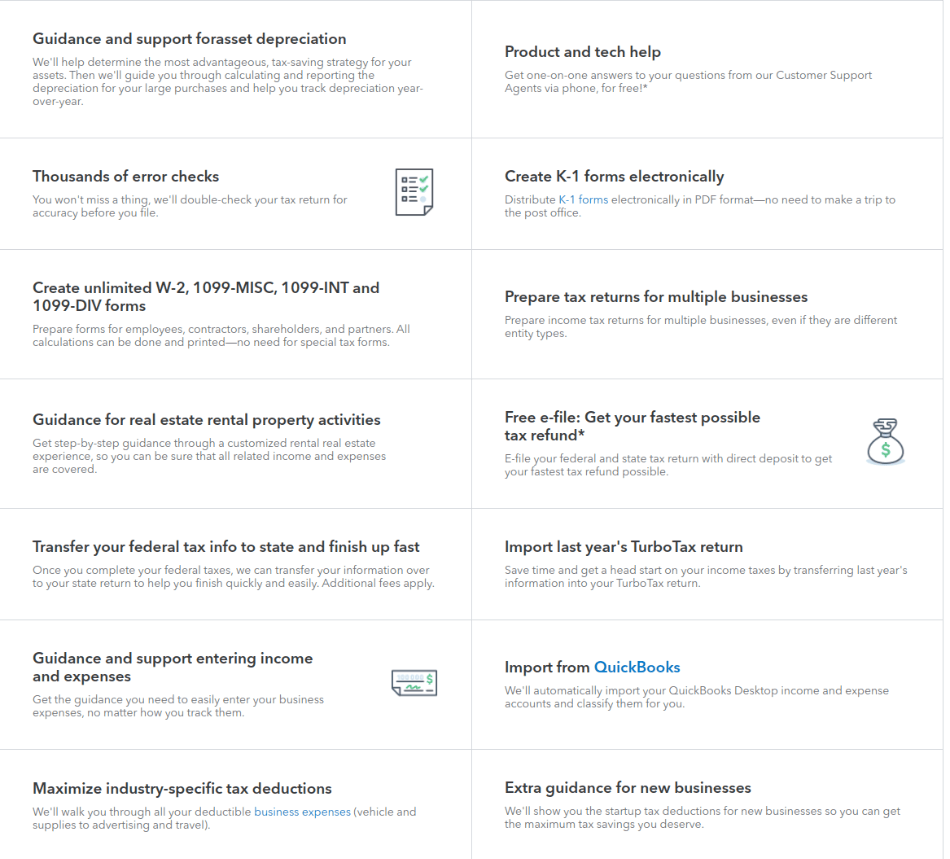

Julia works full time, I work part time, we both get W2 forms in addition to being company directors. Our tax situation isn’t that complex, but also not simple: we have a Limited Liability Company for our home-based business, which needs a separate return in addition to our jobs. That’s great offer, compared to the human accountant Phil had recommended, who wanted to charge us about 10x as much as that. You can pay extra for an additional “live” option, which gives you all year round access to tax experts on tap, either via chat, email or phone. It allows you to compile all relevant data and asks you pay a fee before filing the return.

Several versions have been in existence for a number of years, but the most common these days is of course the cloud-based variant. location, legal status, income, expenses, savings, type of business you’re running etc), takes you through some nice looking menus and (for a fee), electronically files your tax return. How it works (in a nutshell)įor those of you who don’t know, Turbo Tax is a web-based system that asks a number of simple questions about your situation (i.e. Yet with no other choice, and nothing else to lose on such short notice, we gave TurboTax Online a go in 2018 (to file for 2017). I had just survived cancer, and understandably my mind was elsewhere. The US tax system however is so different from what I was used to that I was hesitant to try my hand at self-filing at first. HMRC have a great website, and filing is a breeze – if you have up-to-date accounts. I had been self-filing taxes ever since I started going freelance in the UK in 2000, so I was used to the British system of doing so online, without the help of any other tools. We asked Phil for another recommendation, and in so doing he suggested TurboTax, an online self-filing system available in the US and many other Commonwealth countries (Canada, UK, Australia I believe). He uniquely understood out tax situation and helped us for a number of years… until he unexpectedly retired in 2017.Īt that point he recommended a colleague who charged three times his fee, and while I never questioned the man’s qualifications, we simply couldn’t afford him.

Phil was his name, and he was unique in that he was accredited both in the UK and in the US. Why we started using TurboTax (2018)Įver since our arrival in the US in 2012, we’ve had a wonderful accountant to take care of all our tax needs. Grab a coffee and take a trip around some Intuit products that helped me transform the way Julia and I do our taxes. This is a slightly longer than usual story, but I thought I’d share it nonetheless – maybe it’ll help someone who’s in a similar situation than I was in April 2019, just about to file my tax return in the US.

0 kommentar(er)

0 kommentar(er)